THE GLOBAL BACKDROP IN 2025

The first half of 2025 closed in a global context characterized by high economic and political instability. Italian eyewear, which exports about 90% of its production, faces significant challenges related to the new import duties introduced by the Trump administration and slowing demand in some key markets. At the same time, encouraging signs are coming from Europe and several emerging markets that could open up new growth opportunities.

OVERALL ITALIAN EYEWEAR EXPORTS

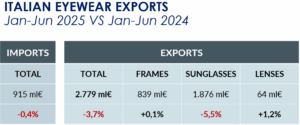

Exports reached 2.8 billion euros between January and June 2025, down by 3.7% compared to the same period in 2024. The decrease mainly concerns the sunglasses segment (-5.5%) which accounts for more than two-thirds of total exports. Frames (+0.1%) were stable, while lenses (+1.2%) increased slightly.

EXPORTS BY GEOGRAPHICAL AREA

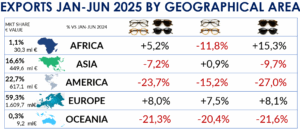

As regards Italian eyewear exports in terms of value, considering the two product macro-segments – sunglasses and frames – by geographical area, we can observe the following trends:

- Europe (+8.0%) remained the leading area, accounting for nearly 60% of total exports. Both traditional markets (Germany, Spain, UK) and some Eastern European countries (Poland, Hungary) are growing, reflecting an increasingly diversified customer base.

- America (-23.7%) is the most affected area, mainly due to the collapse of exports to the United States (-34.5%), historically the top partner with a share of almost 30%. The drop is related to the new import duty regime (10% in the six-month period figures, then raised to 15% since August) making Italian exports less competitive.

- Asia (-7.2%) reflects an uneven picture: declines in several mature markets, but very positive results in China (+29.5%), which has returned to driving demand.

- Africa (+5.2%) and Oceania (-21.3%) remain marginal contributors to overall exports.

EXPORTS BY COUNTRY: MAIN PARTNER COUNTRIES AND OPPORTUNITIES

An analysis of individual countries, reveals the following trend for Italian exports in the sector:

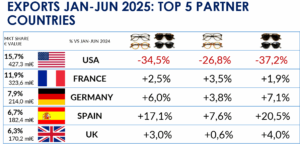

- United States: historically the leading market for Italian eyewear, with a share of almost 30% of total exports, suffered a collapse of -34.5% in the six-month period. The drop reflects on the one hand the introduction of customs duties by the Trump administration, and on the other, a climate of political and economic uncertainty that has slowed down consumption. While remaining the top single destination, the weight of the U.S. fell significantly, forcing the sector to reflect on strategic market diversification.

- France: grew moderately (+2.5%) and remains a major partner. However, internal political tensions have opened up scenarios of instability that could also affect the luxury sector and, by extension, eyewear. In any case, the country remains a high value-added market, where Made in Italy continues to be widely recognized.

- Germany: recorded a solid +6.0%, confirming its position as one of the most reliable markets in Europe. Demand, sustained mainly by frames, proved resilient in a complex national economic context, with the country still close to recession.

- Spain: surpassed expectations with double-digit growth (+17.1%), signaling very positive dynamics. The Iberian market shows a growing interest in Italian products, supported by expanding distribution and greater attention to quality and design.

- United Kingdom: the positive trend continued with +3.0%, despite post-Brexit uncertainties. The British market confirmed its solid appreciation for Italian eyewear, especially in the premium segments.

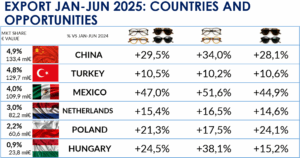

- China: grew significantly (+29.5%), becoming one of the most promising drivers of the first semester. After years of fluctuating performance, the recovery in Chinese demand is an encouraging sign for the sector, especially in the sunglasses and luxury goods segments.

- Mexico: with an exceptional +47%, this was a surprise for an emerging market. The growth may reflect both expanding local demand and the country’s possible role as an alternative hub to circumvent US tariffs, given the North American trade context.

- Eastern Europe: Countries such as Poland (+21.3%) and Hungary (+24.5%) are strengthening their position, showing how even smaller markets can make significant contributions to overall growth.

- Turkey and the Netherlands: both showing double-digit growth, confirming the trend towards diversification of exports to non-traditional markets.

THE DOMESTIC MARKET: OPTICAL CHANNEL SELL-OUT

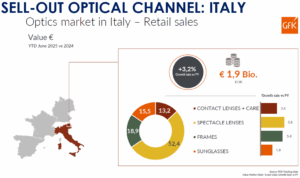

According to GkK-NIQ’s POS Tracking figures, in the first half of 2025, the Italian optical channel grew by +3.2% compared to the same period in 2024, reaching €1.9 billion. This is a positive sign in a domestic consumption scenario that remains fragile, but confirms the resilience of the optical sector.

The increase is driven in particular by the prescription segment (frames and ophthalmic lenses), which continues to represent the predominant part of Italian consumers’ spending in optical centers. In contrast, demand for sunglasses is weaker, affected by both seasonal factors and a growing orientation toward more rational and targeted purchases.

These dynamics reflect an Italian consumer increasingly attentive to value for money and sensitive to innovation (materials, design, sustainability). For the industry, the resilience of the domestic market assumes strategic value: although it represents a smaller share than the large European markets, Italy continues to be an important laboratory for testing trends and new product proposals.

OUTLOOK FOR THE SECOND HALF OF 2025

The context remains challenging: the weight of US duties and political tensions in France are risk factors. However, the strength of the European market, signs of recovery from Asia (particularly China) and sustained growth in emerging markets may open up scenarios of cautious optimism for the second half of the year.

ANFAO President Lorraine Berton commented as follows: “The figures for the first half of the year offer a complex picture: on the one hand, the drop in the United States, impacted by the new duties, and on the other, encouraging signs from Europe and emerging markets. Italian eyewear has shown extraordinary resilience over time, but we cannot tackle such an uncertain global scenario alone.

We strongly invite Italian and European institutions to support our companies with adequate industrial and trade policies, able to defend Made in Italy and make it competitive in international markets. We need practical instruments to nurture innovation, sustainability and promotion abroad.

Our industry is an excellence recognized worldwide and will continue to strive to grow and innovate. But there needs to be a joint public and private commitment to defend and strengthen this unique Italian heritage.”

SUMMARY FIGURES GRAPHS AND CHARTS BELOW

ANFAO elaborations on figures from ISTAT, Coeweb, Gfk-NIQ.