The Board of Directors of Marcolin, among the global leading groups in eyewear, today approved its financial results as of September 30, 2025.

Results as of September 30, 2025

In the first nine months of 2025, Marcolin was able to strengthen and improve its performance, despite an international economic scenario strongly influenced by the current situation of commercial uncertainty in key markets for the industry.

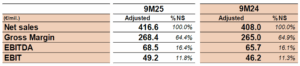

In terms of marginality, the Group reported an Adjusted EBITDA of €68.5 million (16.4% on Net Sales), up 30 bps versus 16.1% as of September 30, 2024, thus continuing the positive path undertaken in recent years.

Net sales also improved, standing at €416.6 million, +2.1% at current exchange rates compared to the first nine months of 2024 (+3.8% at constant exchange rates).

The main geographies markets remained EMEA and the Americas, reporting Net Sales of €218.6 million (+7.6% at both current and constant exchange rates) and €142.7 million (-5.5% at current exchange rates, -1.5% at constant exchange rates), respectively. The Asian market, a high potential area for the Group, fully recovered during the third quarter of 2025 from the temporary deceleration attributable to a different source timing from some big Distributors that occurred during the first half of 2025.

Adjusted Net Financial Position amounted to €326.9 million, an increase of €5.6 million compared to December 31, 2024 mainly due to the temporary cash absorption of net working capital resulting from the typical business seasonality.

During the year Marcolin renewed its key licensing agreements with Max Mara, Guess, adidas and GANT, and signed a new exclusive agreement with rag & bone.

The transaction with VSP Vision is expected to close in the last quarter of the year.